Weekly Thoughts by Mirabaud Securities

China stocks plunge, US earnings tumbling, US macro data disappointment, Boeing ugly, Brexit uncertainty, bond yields plunge and still US stocks surge… The S&P 500 broke above a key technical resistance level but ended back below it (a lower high). Stocks surge on their own on the heels of the biggest short-squeeze since the start of January. We also noticed another surge in buyback-related stocks. In Europe, most of the European markets where up this week with the EuroStoxx50 gaining almost 1 percent (in local currency). Even the FTSE has a nice performance despite the British pound bounce. Finally, in Asia, Chinese indices finally dropped (-1% for Shanghai composite for example) after poor industrial data…

In the G10 environment (against the dollar), the Japanese Yen was the only loser against the dollar. We saw some rebound for the Norwegian Krona, the British Pound and the Swedish krona. In emerging markets (against the dollar) the Philippian Peso, the Turkish Lira and the South African Rand suffered the most this week. On the other hand, the Brazilian Real, the Russian Rubble and the Indian rupee rebounded against the dollar. Finally, investors bought the Euro to US Dollar (amid better economic statistics in the eurozone).

Every European country is different, but the trend for interest rates on mortgages is the same: Downward. In France for example, the latest figures show that the interest rates granted by banks to borrowers in the real estate sector have again decreased from 0.05% to 0.15% in the beginning of March. There are many reasons for this decline. For floating rates, the main explanation is the status quo on key interest rates. For fixed rates, it is a mix of rates of return on government bonds, business conditions, and/or competition. This is positive for European real estate companies and less positive for banks, whose margins continue to fall. The real estate sector has also historically benefited from the launch of LTROs (at least initially). As the sector was hammered in 2018, it could be one of the big (positive) surprises of 2019.

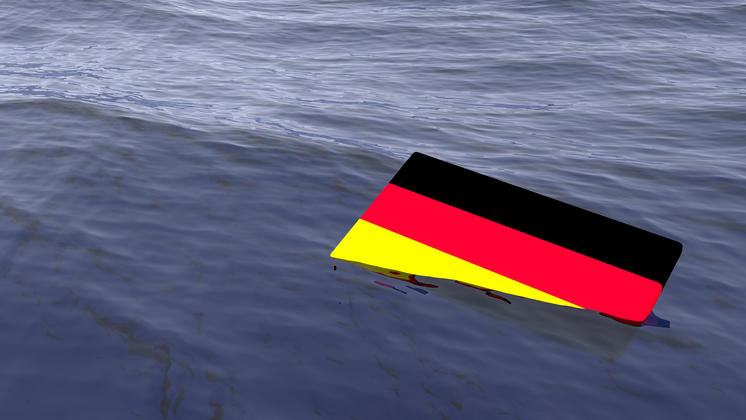

The global order that underpins German prosperity is unravelling. And Angela Merkel doesn’t know what to do about it. President Donald Trump’s America First policy is forcing Germany to make an impossible choice between the U.S. and China. The result is political paralysis at a time when Germany’s allies are looking for political leadership and finally the economy is slowing. A sharp drop in German industrial production has added to fears that the country’s manufacturing slowdown has extended into 2019 and will weigh on the eurozone economy. Industrial output fell 0.8 per cent in January, Germany’s statistics office said on Monday, in an indication of the threat to exports from weaker global demand and political uncertainty. The drop supports the findings of business confidence surveys, which have suggested that manufacturers in the eurozone’s largest economy continue to struggle.

Two deadly crashes in a span of less than five months involving one of the most modern aircraft in the market, the Boeing 737 MAX 8, have prompted aviation authorities and airlines to draw similarities between the two incidents. The aircraft, the latest in line of Boeing’s 737 family, is being considered by major 737 operators as a replacement model for the hundreds of 737 NG that are in operation today. By the end of January, Boeing had delivered 350 of the Max 8 model out of 5’011 orders. A small number of Max 9s are also operating. Approximately 2/3 of the world's 737 Max 8 fleet have been grounded according to the Times - with the European Union Aviation Safety Agency (EASA) the latest entity moving to ban the plane. President Trump, meanwhile, suggested in a Tuesday tweet that some new planes are "too complex to fly" and grounds 737 Max planes…. The share price dropped almost 15% this week.

Several hot topics were discussed this week, including:

Brexit: What to expect / Germany on the brink / Mortgage rates / warning on the chemical sector /Broadening our investment horizon

Please feel free to ask for more information if interested.

“(US) Inflation target is met" (STRENGHTS) is on the cliff this week. The CPI, a key measure of underlying U.S. inflation unexpectedly eased in February amid falling prices for autos and prescription drugs, giving the Federal Reserve more room to stick to its plan for being patient on raising interest rates.

SWOT stands for Strengths, Weaknesses, Opportunities and Threats, the French equivalent of FFOM analysis (Forces, Faiblesses, Opportunités et Menaces). While SWOT analysis can be used to develop a company's marketing strategy and evaluate the success of a project (by studying data sets such as company's strengths and weaknesses, but also competition or potential markets), I decided several years ago to adapt it as a way to analyse financial markets. SWOT analysis allows a general development of markets by crossing two types of data: internal and external. The internal information taken into account will be the strengths and weaknesses of the market. The external data will focus on threats and opportunities in the vicinity. Finally, and most interestingly, there is a table that will evolve according to current events, which will allow it to reflect the underlying trend in the financial markets on a weekly basis.

Zögern Sie nicht, sich an Ihren persönlichen Ansprechpartner bei Mirabaud zu wenden oder kontaktieren Sie uns hier, falls dieses Thema für Sie von Interesse ist. Gemeinsam mit unseren Fachspezialisten evaluieren wir gerne Ihre persönlichen Bedürfnisse und besprechen mit Ihnen mögliche, auf Ihre Situation zugeschnittene Anlagelösungen.

Weiter zu