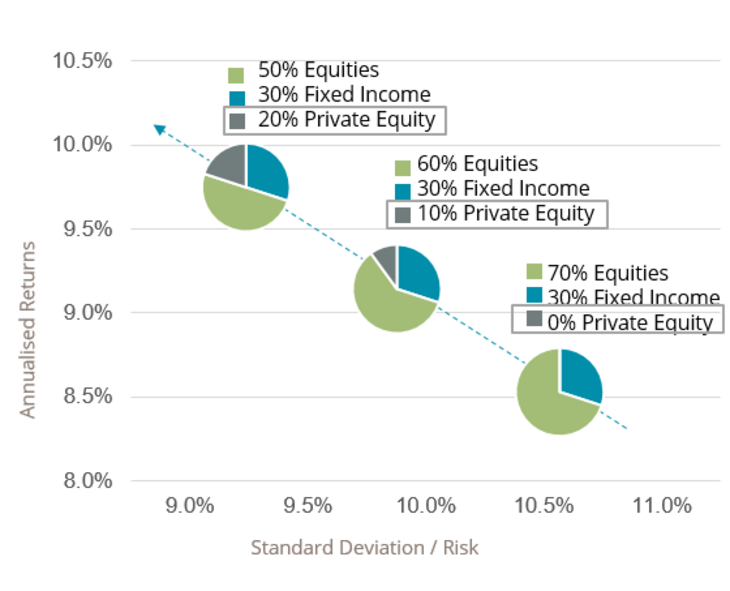

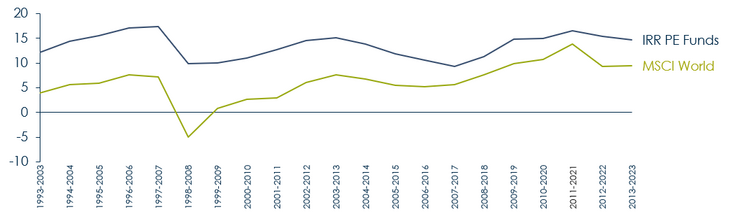

Investing in private equity has become an increasingly relevant strategy for investors worldwide. Although it is sometimes perceived as a 'new' option, this asset class has decades of history and has proven to offer consistent benefits in terms of returns, diversification, and access to a broad range of opportunities.

Wealth Management

Private Equity: a timeless strategy for attractive returns and diversification