Weekly Thoughts by Mirabaud Securities - 08 November 2019

Dow Jones Industrial, Nasdaq, S&P 500 or even the Swiss SMI closed at new high this week on trade deal optimism. Nevertheless, during the last five trading days, volume in put options has lagged volume in call options by 53.09% as investors make bullish bets in their portfolios. This is among the lowest levels of put buying seen during the last two years, indicating extreme greed on the part of investors. Over the week, the Dow Jones Industrial ended flat and the Nasdaq up almost 1%. The same mild trend for European indices with an average increase of nearly 1.5% despite the Brexit uncertainties. In Asia, most of the indices were fueled by hopes on trade agreement between Washington and Beijing.

Despite the fact that Denmark is part of the European Union (EU), this beautiful country still uses its own currency (and the euro). The Danish krone is part of ERM II (European Exchange Rate Mechanism), so its exchange rate is pegged to the euro, with a fluctuation band of 2.25%. Over the past week, however, for no apparent reason, it has experienced one of the largest declines against the dollar. At the G10 level (excluding the Danish krona), the Norwegian krona, the Swedish krona and the Australian dollar finished the week positively against the dollar. The Japanese yen and the euro were under pressure against the dollar. At the emerging market level, the South African rand, the Argentinian peso and the Malaysian ringgit (against the dollar) experienced increases over the week. The Hungarian forint and the Brazilian real managed to finish in red.

Nanotechnology is one of the topics I am looking at very closely as its growth is becoming more and more exponential. Despite a very large number of players, investing in it is quite simple, whether through start-ups or leaders in search of miniaturization. As a reminder, Nanoscience and nanotechnology are the study and application of extremely small things and can be used across all the other science fields, such as chemistry, biology, physics, materials science, and engineering. Nanotechnology is actually shaping the future of medical treatment with the development of smart pills, particles to specifically target cancer cells or nanoscale sensors embedded directly into the implant or surrounding area that could detect infection. Examples like this shows the true promise of nanotechnology in the field of medicine. Before long, gathering data from within the body and administering treatments in real-time could move from science fiction to the real world.

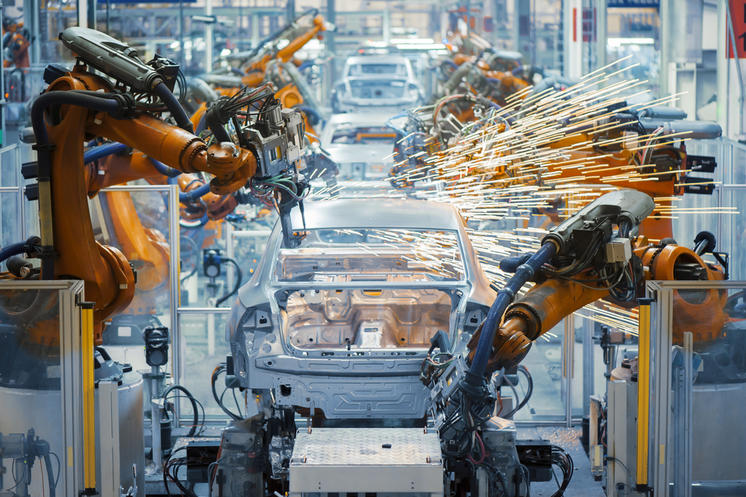

Almost 3 months ago I wrote that the automotive sector was close to an interesting tactical rebound. Today, between consolidation (Peugeot & Fiat-Chrysler or Hitachi & Honda), fundamentals, cyclical rotation and softening US aggression against European car manufacturers, the sector has experienced an impressive performance. Nevertheless, the positive trend could still have room for improvement. First, technically speaking, we can see that the sector has formed a fairly clear inverted head and shoulders. Then, according to the momentum data published by Bloomberg, the automotive sector is in an improvement phase. Fundamentals are also stabilizing or even improving. China is another supporting factor since the announcements that some car tax reductions could be put in place by the Chinese government at the end of 2019. Finally, the dovish ECB tone is also feeding cyclical sectors.

Uber Technologies Inc beat Wall Street estimates for third-quarter revenue, as more people used its ride-hailing and Uber Eats restaurant delivery service. Total revenue rose nearly 30% to $3.81 billion, beating analysts’ average estimate of $3.69 billion. Uber’s costs jumped about 33% to $4.92 billion in the reported quarter. Gross bookings, a measure of total value of rides before driver costs and other expenses, rose 29.4% from a year earlier to $16.47 billion. The company said its monthly active platform users rose to 103 million globally in the third quarter, from 82 million a year earlier. Net loss attributable to the company widened to $1.16 billion, in the quarter ended Sept. 30, from $986 million, a year earlier. Shares of Uber were also under pressure on Wednesday, when a restriction on selling stock was lifted. Some analysts expect more than 80% of the company’s outstanding shares, will become eligible for sale. Time to take a cab?

Several hot topics were discussed this week, including:

What does a recession mean for markets? / Automotive sector: update / Millennials loves renting and sharing / Don’t fear nanotechnology / Cyber attacks

Please feel free to ask for more information if interested.

* On the cliff

SWOT stands for Strengths, Weaknesses, Opportunities and Threats, the French equivalent of FFOM analysis (Forces, Faiblesses, Opportunités et Menaces). While SWOT analysis can be used to develop a company's marketing strategy and evaluate the success of a project (by studying data sets such as company's strengths and weaknesses, but also competition or potential markets), I decided several years ago to adapt it as a way to analyse financial markets. SWOT analysis allows a general development of markets by crossing two types of data: internal and external. The internal information taken into account will be the strengths and weaknesses of the market. The external data will focus on threats and opportunities in the vicinity. Finally, and most interestingly, there is a table that will evolve according to current events, which will allow it to reflect the underlying trend in the financial markets on a weekly basis.

Zögern Sie nicht, sich an Ihren persönlichen Ansprechpartner bei Mirabaud zu wenden oder kontaktieren Sie uns hier, falls dieses Thema für Sie von Interesse ist. Gemeinsam mit unseren Fachspezialisten evaluieren wir gerne Ihre persönlichen Bedürfnisse und besprechen mit Ihnen mögliche, auf Ihre Situation zugeschnittene Anlagelösungen.

Author

Weiter zu