Diabetes devices and how one Swiss medical technology company is adding value

All types of diabetes share a common problem: too much glucose in the bloodstream. The body cannot take up glucose (sugar) into its cells and use it for energy. The consequences of diabetes can cause damage to important organs of the body such as heart, kidneys, eyes or nerves.

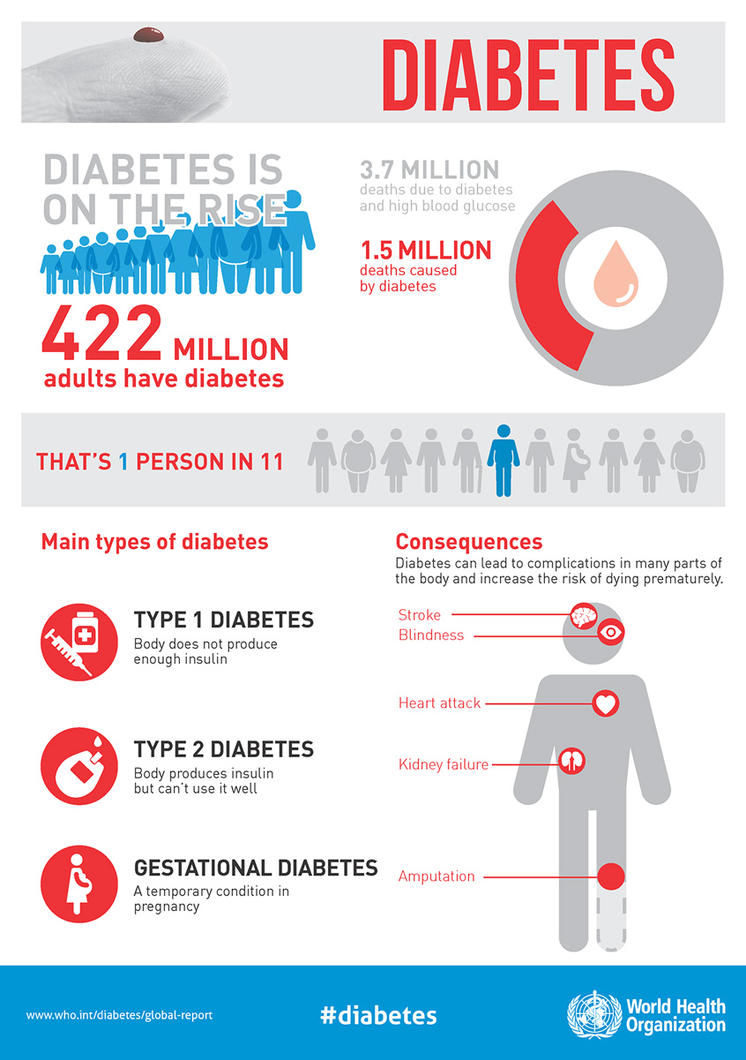

The number of people with diabetes increased five-fold from 100m 40 years ago to close to 450m in 2020. About 8.5% of adults have diabetes. The USA has one of the highest prevalence rates with 13% of the US adult population or 34.1m affected. The percentage of adults with diabetes not surprisingly increases with age, i.e. 27% of people over 65 years have diabetes in the USA. The WHO estimates that in 2019 about 1.5m deaths were directly caused by diabetes.

The treatment for diabetes is not as simple as it may seem at first glance. Whilst most Type 2 diabetes patients can be treated with a variety of new oral drugs, the treatment of Type 1 diabetes where the body does not produce enough insulin is highly complex. About 10% of people with diabetes have Type 1 diabetes. The immune system attacks and destroys cells in the pancreas where insulin is made. Today, there are 4 main insulin categories commonly used, ranging from rapid-acting, short-acting, intermediate-acting and long-acting insulin which can last for 24 hours or more.

We estimate that in the developed world about 15.5m patients have Type 1 diabetes, of which the majority uses either conventional syringes to administer insulin or injection pens. Only about 11% or 1.7m people use a much more efficient insulin pump or patch. Out of the 1.7m, about half or 850,000 are based in North America and close to 1/3 is in Europe. We expect the insulin pump market to grow double-digit globally for many more years to come, driven by a rising prevalence of diabetes and the still low insulin pump penetration of 11% (1.7m people out of 15.5m).

The insulin pump market is dominated by US medtech giant Medtronic, as well as fellow American Tandem. The market is highly tough and highly competitive. Other big players such as Animas (subsidiary of Johnson & Johnson) announced in October 2017 they would discontinue the insulin pump business and subsequently transferred patients to Medtronic. Roche similarly made the decision to stop selling pumps in the USA at the end of 2016. That demonstrates just how tough this business is.

So why should the rather smaller player Ypsomed - compared to a Roche or J&J - have a chance in this market? We believe that Ypsomed addresses several of the more difficult aspects of the sector: it has been active in the market for many years and knows the diabetes industry inside out. The roots of Ypsomed were formed in Disetronic, which sold the insulin pump business to Roche in 2003.

It then continued to expand with injection devices and today is the world leader in that space. The YDS Ypsomed Delivery Systems provides injection systems for self-medication with a modular platform technology. We expect that half of group sales this year will come from the YDS segment and that it will grow at least in the mid-teens for many more years. This segment is the cash cow of the company with very high margins. Ypsomed currently wins 6 out of 10 projects with pharma and biotech customers for either pens, auto-injectors or for the next big thing, patch injectors for more valuable drugs for treatments such as oncology.

Ypsomed’s other segment YDC (Ypsomed diabetes care) accounts for the other half of group sales and is currently loss making with the build-up of the franchise. The upside is enormous, as Ypsomed currently has an ‘installed base’ with its YpsoPump insulin pump of just 17,000 users, or 1% market share. Medtronic remains the leader with more than 1m users or 63% market share, followed by Tandem with 144,000 users or 9% share. The YpsoPump has several distinctive features which make the pump very attractive and easy-to-use for new patients: it is small, has a modern touchscreen and a self-filled reservoir for any insulin. It is easy to operate and with only 1 hour of training, the patient should be able to use the pump. This is far less than that of competitors.

The pump has a weight of only 83 grams (half the weight of the pump of Medtronic) including the battery and a filled insulin cartridge. The icing on the cake is the new partnership with insulin market leader Eli Lilly for the US market (50% market share). As of mid-2022, the companies will launch a white labelled insulin pump (with the YpsoPump as a base) and therefore Ypsomed has no cost to build-up its own, expensive US sales force. Lilly itself can offer an attractive bundling package (insulin, pump, blood glucose sensor) to insurers and distribute it through new channels such as pharmacies.

Por favor no dude en comunicarse con su persona de confianza en Mirabaud o contáctenos aquí si este tema es de su interés. Junto a nuestros dedicados especialistas estaremos encantados de evaluar sus necesidades personales y discutir posibles soluciones de inversión adaptadas a su situación.

Continuar con

Equity Research

Equity Research