Equity Research

Is it 2022, or is it 2000 again?

Equity Research

Meta has seen $800 billion of market cap wiped out from its September 2021 peak, and Amazon has lost $945 billion of market cap in the last 12 months. Microsoft’s percentage change over 12 months has declined less than the previous two mentioned companies, but still equates to a $1 trillion decline in market cap. Alphabet has $663B less market cap than it did in November last year, and Apple has lost $511 billion since the January 2022 highs. This entire market cap lost by the big 5 of $3.9 trillion is greater than the entire current market cap of the Euro Stoxx 50 ($3.5 trillion).

One thing is for sure with regard tech investing in November 2022: there isn’t much conviction among investors right now. Many people are keen to find long ideas of companies which could be champions of the next generation tech cycle – but are unwilling to deploy capital if they risk losing c.20% before making 4x or 5x. Investors are trying to grapple with whether the last few months are just a short-term speed bump (as sell-side consensus certainly portrays) or whether it is the start of a multi-year phase of underperformance for the industry – as happened post 2000.

What are the parallels?

Back in 1999/2000, technology enjoyed rapid growth with a major increase in IT budget spending, not only on the expected Y2K bug itself but software, hardware and predictions (an ML survey in 1999) that 40% of PC users will need an urgent upgrade to compliant systems. The survey also highlighted services, storage, servers and enterprise software as growth areas in IT spending because of the millennium. But there was expected to be no ‘nuclear winter’ on spending thereafter because forecasts suggested a shift away from a Windows-based client server environment, the rise of Java applications open software becoming mainstream and disruptive elements of Linux. On the one hand, there were many analogies made between Y2K and natural disasters. On the other, research from IDC put total worldwide spending from 1995 to 2001 on the Y2K problem at c.$300b, or 2.9% of total IT spending (according to IDC's The Financial Impact of the Y2K Problem report). Y2K was seen as a productivity killer by economists, as dollars and intellectual capital had to be diverted to fix the ‘bug’. However, a Stanford study debunks this as a myth with a big factor in the loss of 1.5m jobs since Y2K and 2005 due to Y2K spend improving business efficiency and productivity. By cleaning up inefficient work streams, and outdated software, the Y2K event led to modernisation of IT infrastructure. The United States Senate Special Committee on the Year 2000 Technology Problem also concluded that in addition to averting major problems, Y2k preparations provided "enduring" benefits. "Most significantly, the IT infrastructure and mechanisms for more effectively managing it have been modernized," the report states. "Also, Y2k has caused a heightened level of knowledge among executive-level managers as to the importance and vulnerabilities of information technology.”

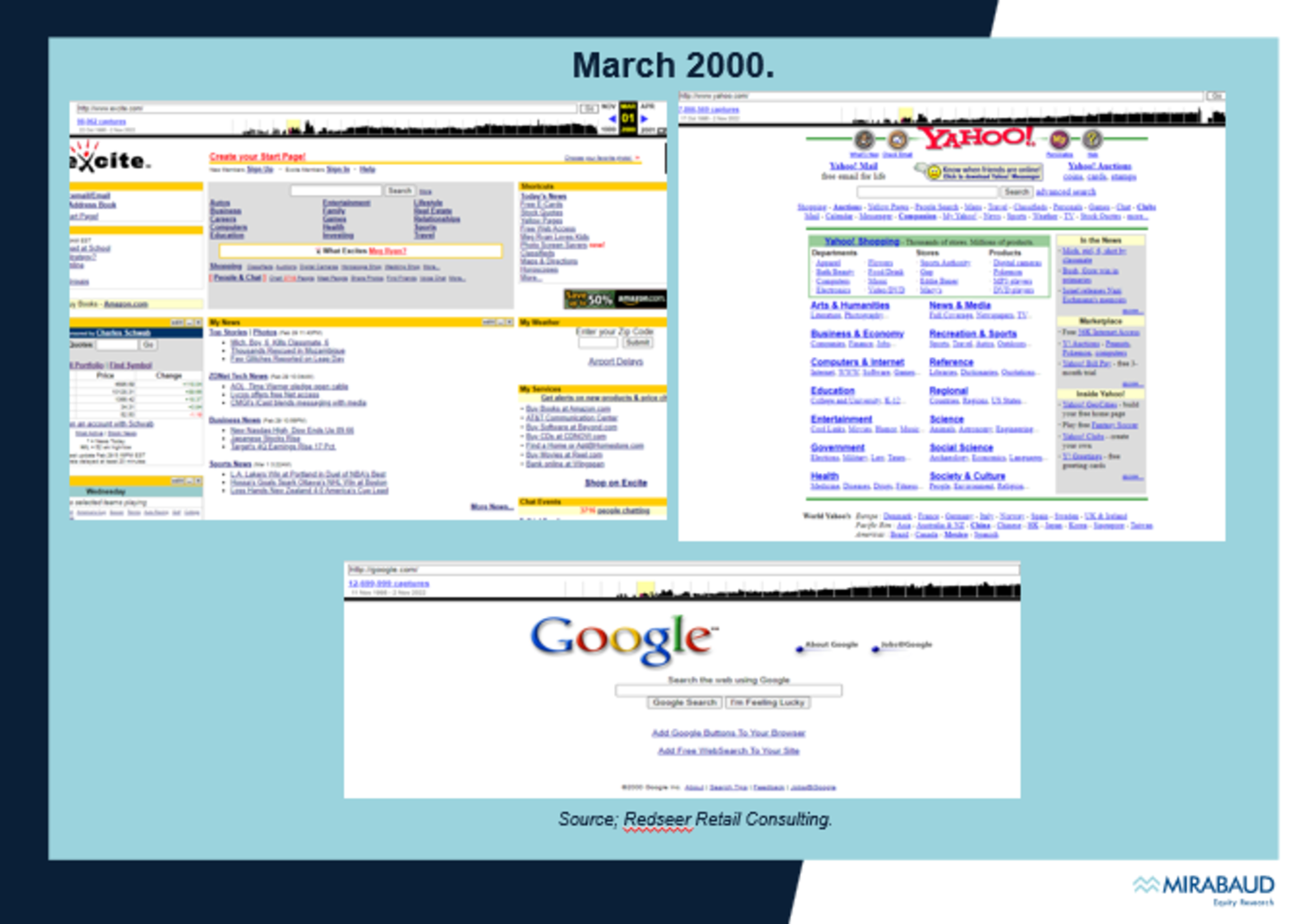

During the approach to the new millennium, businesses had options to migrate from mainframe to client–server computing systems, adopt enterprise resource planning (ERP) and customer relationship management (CRM) systems, and develop e-business applications. Because two-digit dates were pervasive in legacy systems developed during the 1970s and 1980s, most large firms faced significant costs to make existing systems Y2K compliant. Resourceful firms could have taken advantage of the Y2K situation to evaluate and update their IT infrastructure. Companies who decided to replace their legacy systems simultaneously obtained the side benefit of Y2K compliance (infrastructure investment and software upgrades) and set in motion the next wave of entrepreneurial firms. Sometimes, as these events play out, there are fledgling industries which fall at the proverbial first fence. But there is always a thoroughbred that is able to eventually come through the field. For the plethora of Yahoo, Excite, WebCrawler, Lycos, Alta Vista and Ask Jeeves in search – then came Google. For the Silicon Valley mantra, KISS (KEEP IT SIMPLE, STUPID), which of these stood the test of time?

Fast forwarding to the current day, one could see how the Y2K similarity has been made to the ‘COVID-cycle’. Was too much expectation placed on the pace of the shift to online spending, for example? That the rebirth of PC growth was sustainable? That the dormant gamers who rediscovered their love for gaming would return, for good? That crypto would replace Fiat Currency? That the Fed issuing cheques to day traders created a new economy of investors (shades of the 1999 taxi drivers in NYC). That the surge in EV listings via-SPAC had created the capital required to disrupt one of the final outposts for technology in the form of transport.

These times of uncertainty do create the opportunity to uncover next generation winners. The trends of digital transformation will continue, and secular drivers continue - it is just the pace of the transformation has needed to be adjusted. Technology is not a discretionary investment; it is a requirement. In the examples above, Shopify could become THE viable alternative eCommerce end-to-end platform of next gen eCommerce to Amazon. A new form of entertainment could rise from the ashes of gaming and OTT saturation. Perhaps Ethereum becomes a trusted blockchain technology. There is likely to be an EV disruptor, perhaps Polestar, but the majority will run out of cash before you can even say the words “range anxiety”. In the early 2000s there was money to be made in technology stocks – but it wasn’t a question of beta, but of alpha generation. Finding the hidden gems among the wreckage, as it were. 2023 is likely to present a similar opportunity.

Por favor no dude en comunicarse con su persona de confianza en Mirabaud o contáctenos aquí si este tema es de su interés. Junto a nuestros dedicados especialistas estaremos encantados de evaluar sus necesidades personales y discutir posibles soluciones de inversión adaptadas a su situación.

Continuar con