Sustainable and Responsible Investing

The Inflation Reduction Act or reviving the economy through the production of green technologies

Sustainable and Responsible Investing

For a number of observers, this legislation, which calls for nearly $370 billion in green technology spending, represents a major domestic political success for the Biden administration, a massive boost to the economy, and most of all, a revolution in the fight against climate change. At a European level, while many leaders have criticised the protectionist effects of the IRA, the European Commission is not to be outdone and is preparing its response, in the form of its Green Deal Industrial Plan.

The IRA is a multi-billion dollar legislation package that aims to “green” and grow a US economy that still remains heavily reliant on fossil fuels, by providing subsidies and tax breaks to the clean technology industry. In addition to the climate aspect, which is causing a stir, given the size of the budget, the legislation also aims to reduce the US budget deficit by introducing a new tax on US companies’ profits (15%) as well as strengthening the social security system through a reduction in medicine prices. The climate package, totalling almost $370 billion, will provide investment and production tax credits for US companies engaging in green technologies. As shown in the table below, the main areas concerned include renewable energy, nuclear energy, electric vehicles, batteries, green hydrogen production, energy efficiency in buildings, carbon capture and biofuels, among others.

With the IRA, the US is now implementing the Paris agreements by drastically reducing its CO2 emissions. Another key feature of the IRA is that it promotes the production of clean technologies “made in America”. In other words, US citizens are encouraged to buy US-branded electric cars composed of electronic materials produced on US soil. The underlying objective of this strategy is to overcome the dependence on China for electronic components used in clean technologies. The International Energy Agency estimates that China controls 60% of the production capacity of all batteries, solar panels and wind turbines.

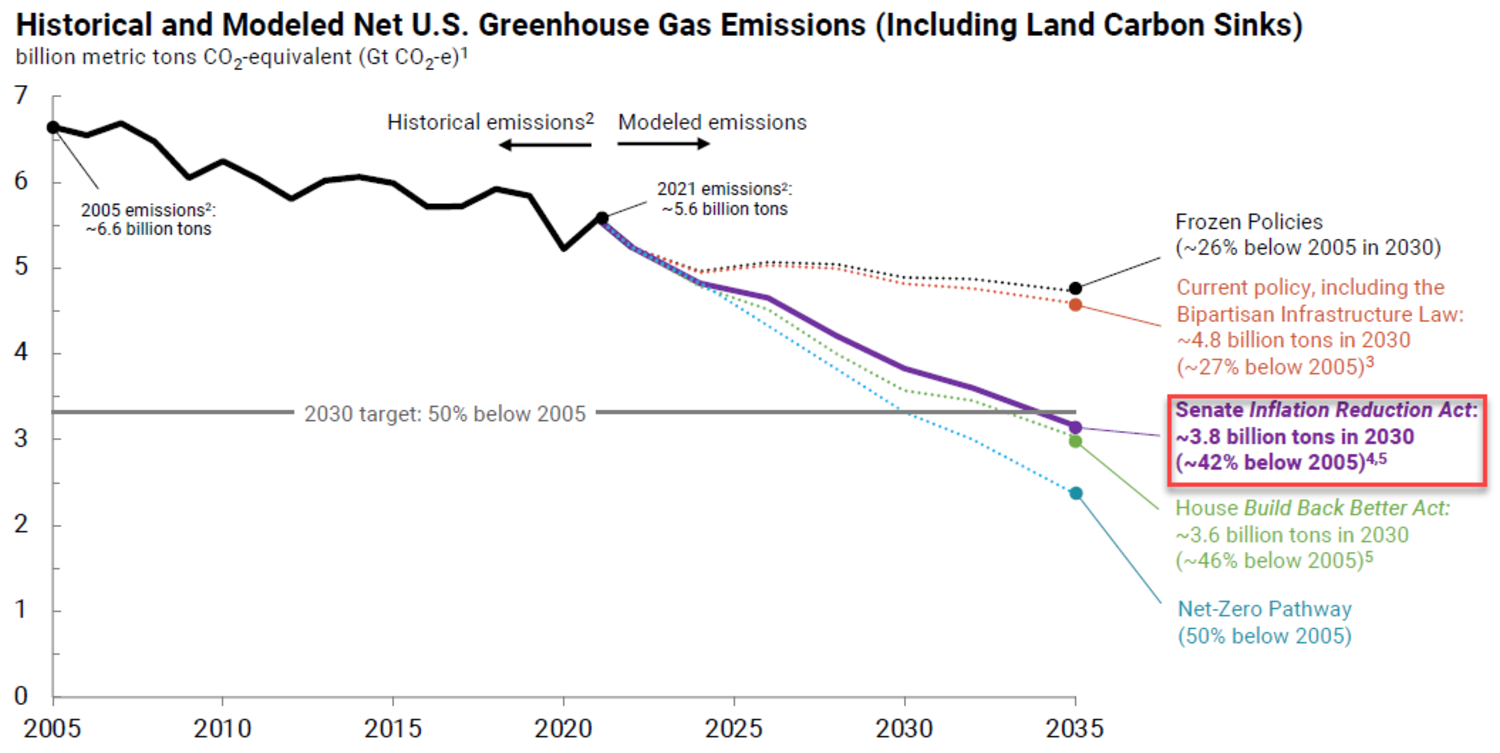

Undoubtedly, the IRA marks a fundamental shift in the way the US tackles the climate issue. Experts predict that, if combined with existing policies, the IRA could deliver a reduction of around 46% in emissions by 2030 compared to 2005 levels.

According to the World Economic Forum, this will lead to the creation of several hundred thousand jobs related to clean energy issues, thereby helping achieve the deflation objectives targeted by the programme. Over and above the climate issue and economic growth, the IRA directly benefits a number of sectors and companies leading the way on clean technology issues,both American and those with production activities based in the US. The automotive sector offers an interesting example. Thanks to a government subsidy of USD 7.5 billion for the purchase of a new electric vehicle, American car brands, led by Tesla, will significantly benefit from this windfall. This applies to the entire value chain of the electric vehicle sector, from the manufacturers of electronic components (semiconductors such as NXP Semiconductors) to the suppliers of minerals for batteries (such as lithium). It will not just be US companies who will be interested in the tax incentives, but also European companies looking to invest and relocate their production activities to the US. In November 2022, following the approval of the IRA, the Spanish company Iberdrola announced its plan to invest $36 billion in renewable energy and electricity networks, with the aim of making 47% of this investment in the United States. Volkswagen, Hyundai, Honda and Toyota have also shown interest in expanding their production in the US to take advantage of these subsidies.

The “protectionist” nature of the IRA −one that has been fully endorsed by the US government− initially raised concerns among several European leaders who condemned it as a breach of international trade rules. The European Commission subsequently unveiled its EU Green Deal Industrial Plan (GDIP) in February 2023, designed to address the IRA and China’s dominance in the production of green technologies. The aim is to create a more favourable environment for the roll-out of the industrial expertise necessary to become the first continent to achieve climate neutrality by 2050. However, unlike the American climate strategy, which is based solely on subsidy mechanisms that are easily accessible throughout the country, the European plan is already being criticised for being politically complex (27 member states requiring coordination) and an overly bureaucratic structure. The next steps, including the introduction of the Net-Zero Industry Act and the Critical Raw Materials Act later this month, will be crucial.

Whilst this economic and geopolitical competition surrounding green technology production may seem fierce, it does have the virtue of (finally) providing answers to the climate emergency.

Por favor no dude en comunicarse con su persona de confianza en Mirabaud o contáctenos aquí si este tema es de su interés. Junto a nuestros dedicados especialistas estaremos encantados de evaluar sus necesidades personales y discutir posibles soluciones de inversión adaptadas a su situación.

Continuar con